Short sellers are called tons of things. Bloodsuckers. Parasites. Other words do not fit the print. Now within the whirlwind engulfing GameStop Corp., they need a replacement name: the establishment.

It’s a task cast for them with relish by their chat-room usurpers, the tens of thousands of average Joe day-traders whose fervor for a left-for-dead retailer has become a self-fulfilling prophecy in its 245% rally this year. GameStop has become a money jet for the options-obsessed crowd that meets in Reddit’s WallStreetBets forum. For those wagering on a decline, it’s been a catastrophe.

Give credit where it’s due. In their frenzy, WSB’s cocky hordes have managed to show the tables during a game short-sellers invented, spinning gold from the complacency of others. Before this year, GameStop was a register for bearish traders, who borrowed and sold more shares than the corporate-issued. Hedge funds had been winning goodbye that they overlooked the tinderbox they were creating should sentiment turn.

Now it has, violently. GameStop, which isn’t expected to show a profit before 2023, has seen its market price triple to $4.5 billion in three weeks, burning the skeptics whose any plan to cover is probably going to further propel its ascent.

A notable victim of the shift has been Citron Research’s Andrew Left, once Wall Street’s most celebrated iconoclast for his role hounding Bill Ackman out of another battleground stock, Valeant Pharmaceuticals, five years ago. Today, Left finds himself first among the hunted, his decision to prevent publicly bashing GameStop helping drive it up the maximum amount as 78% on Friday.

“Price movement aside, I'm most astounded by the thought process that goes into creating these decisions,” Left said in an email to Bloomberg News on Monday. “Any rational person knows this sort of trading behavior is brief lived.”

Last week, before he decided to travel mute on GameStop, Left issued a plea to would-be buyers: “look at valuations,” which are by some measures stretched. Ironically, in tracing the history of WallStreetBets’ fascination with the stock, that’s exactly what the chat-room faithful said they were doing once they began on their journey. Here’s the story of that uprising.

Twenty-two months ago, inklings of a bull case started exposure on WallStreetBets, the Reddit forum that has become synonymous with retail zeal within the pandemic age. With GameStop’s shares and profits both coming for years, a hair by user “Delaney” said detractors were undervaluing the retailer’s cash, with which the shares were deceptively cheap

“My thesis isn't contingent a turnaround or business expansion, this is often solely a deep value play,” wrote Delaney. “Even if we expect double-digit top-line business declines and margin of profit contraction, the businesses valuation doesn't reflect the present earnings power, especially when considering the businesses large cash crowd.” (WSB posters aren't distinguished by their spelling or punctuation.)

The view fell totally on deaf ears because the shares continued to tank and enrich bears. GameStop fell 15% in April of one year, 12% in May, 28% in June, plus 27% in July. Yet two things appeared around that point to get the inspiration for the events of this month.

One was Michael Burry –- of massive Short fame and therefore the veritable spirit animal for internet stock gurus hoping to hit the large time –- saying he was long the shares through his fund Scion Asset Management.

The second was the surfacing of view, first in jest, that eventually evolved into this blueprint for the crowd-sourced short squeeze that has blown up in January. Could GameStop fall thus far on make a takeover possible -- by WallStreetBets itself?

It would only cost about $45 million to shop for up the whole float if the stock dropped to 50 cents a share, said user MGE5 during a June 5, 2019, post.

The stock closed at $5.04 that day, but after a 36% plunge from the day prior anything seemed possible for one among Wall Street’s most hated stocks. The notion was met with derision and sarcastic suggestions typical of WSB’s usually juvenile ambiance, but the genie was out of the bottle. What if the renegades could gang to flood one security?

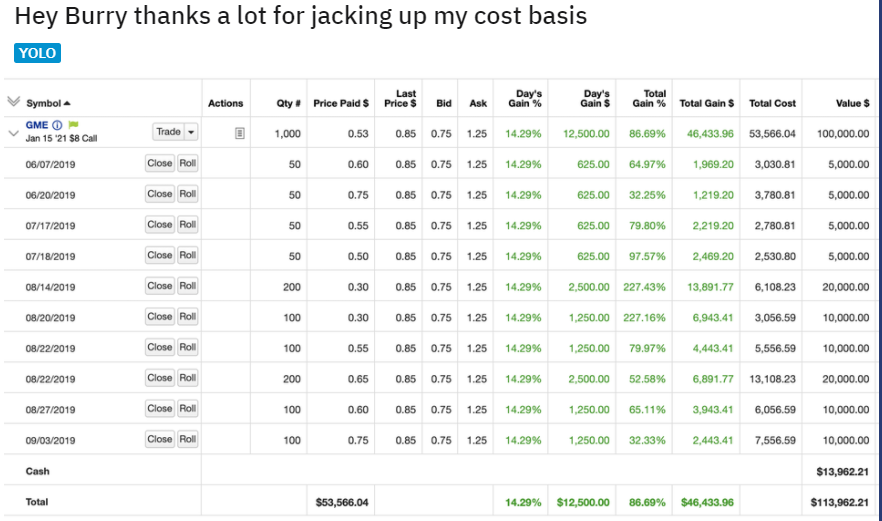

Around this point, a Reddit work surfaced that has become the de facto champion of the WSB bull case at GME, a user going by DeepF-----value -- name edited for content -- brandishing his “tendencies.” (For the uninitiated, tender are WallStreetBets slang for gains; the etymology of the word comes from chicken tenders, widely considered a dish suitable for kings and financial oligarchs.)

Just three weeks after an Aug. 19, 2019, handout from Burry’s Scion urging GameStop to shop for back $238 million in shares and a Seeking Alpha post warning about the risks of shorting GameStop, the forum’s future hero showed the products.

While the battle was faraway from won, DeepF-----value, who goes by Roaring Kitty on YouTube, became the primary to point out that there was money to be had in those empty aisles flanked by computer game discs Wall Street analysts said nobody needed to shop for.

But the forum was still not adopting the position en bloc.

A value proposition was 1 thing, but there was never a guarantee of success. The shares rallied from August 2019 through October, then went sideways until the top of the year before following the market down because of the Covid-19 pandemic spread.

Another online watershed occurred when user “Senior_Hedgehog” alerted the YOLOing masses to the “biggest short squeeze of your entire life.” it had been April 13, 2020, and, consistent with the earlier Hedgehog, 84% of the retailer’s shares were taken short. the ultimate all-caps sentence imploring GameStop owners to call their brokers and tell them to not lend them short opened a replacement theater to wage war against short-sellers.

0 Comments